80 professorer eniga: hellre indexfond än ett fåtal enskilda aktier

Helt samstämmiga svar från världens ledande akademiker och nobelpristagare

Åttio professorer – varav 6 nobelpristagare – fick frågan: ”Vad kan en småsparare förvänta sig bäst resultat från: en billig och bred indexfond eller ett fåtal enskilda aktier?” De fick dessutom ange hur säkra de var på sin sak på en skala 1-10. Svaret är tydligt. 68% instämde helt (”strongly agree”) och 32% instämde (”agree”) även de. Några kommenterade även sina svar med: ”Nobrainer”, ”All my savings are in index tracker, so i am living this view!” och ”Lots of evidence”.

Innehållsförteckning

- Sammanfattning, guldkorn och citat

- Därför är denna undersökning viktig

- Så gjordes undersökningen

- Det slående resultatet

- Nobelpristagarnas enhällighet

- Experterna motiverar sina svar

- Diversifieringens kraft

- Vem deltog i undersökningen

- Varför experterna har rätt

- Den praktiska betydelsen

- Introduktion

- Sammanställning av svaren

- professorernas svar

- Vanliga frågor

- Konkreta saker du kan göra nu

- Communityns tankar, tips och inspel

- Relaterade sidor och annat kul

- Senaste nytt på RikaTillsammans

Denna sida uppdaterades 3 månader sedan (2025-07-27) av Jan Bolmeson.

Sammanfattning och guldkorn

Det viktigaste att veta. Swipa för att se fler.

Introduktion

Kent A. Clark Center for Global Markets, Chicago Booth, frågade 92 ekonomprofessorer från världens ledande universitet för att få deras syn på en fundamental investeringsfråga: Kan småsparare förvänta sig bättre resultat från indexfonder jämfört med enskilda aktier?

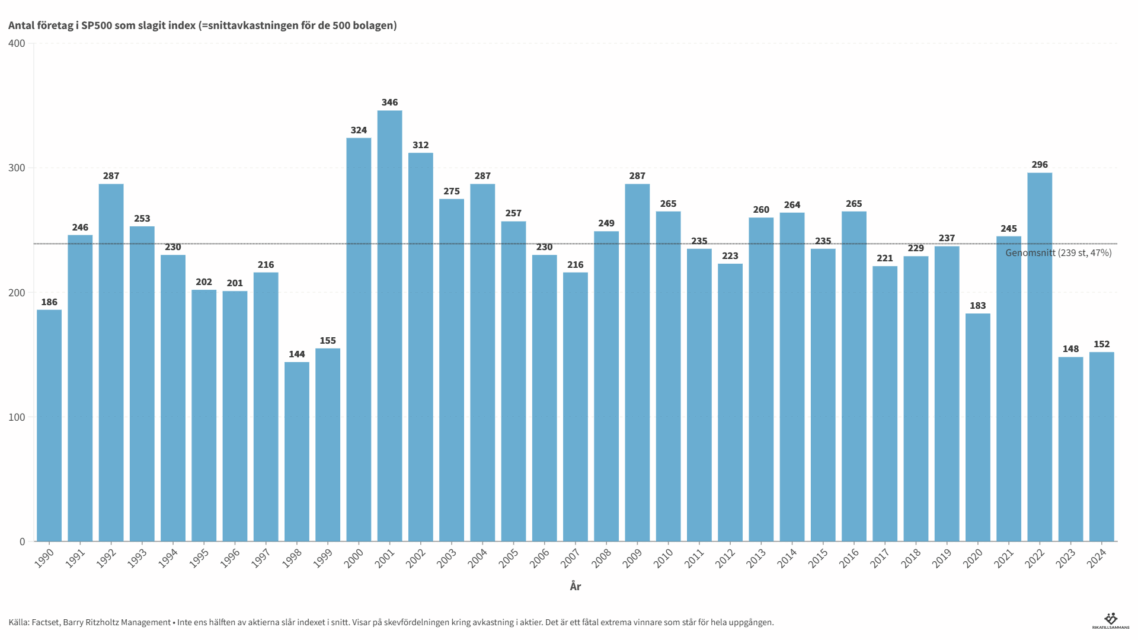

Resultatet är slående. Av de 80 som svarade instämde 68% helt (’strongly agree’) och 32% delvis (’agree’) i påståendet. Ingen enda professor höll inte med. De som inte svarade var endast 14% av totalen. Genomsnittlig konfidens bland de svarande var 8,1 på en skala från 1-10.

Särskilt intressant är nobelpristagarnas enhälliga stöd. Richard Thaler (Chicago) kallade det ’Investing 101’, medan Bengt Holmström (MIT) gav maximal konfidens (10/10). Christopher Pissarides (LSE) kommenterade: ’Även om du får rätt ibland kommer du till slut att få fel.’

Professorerna motiverade sina svar med diversifieringens fördelar, låga kostnader och bristen på bevis för att privatpersoner konsekvent kan slå marknaden. Christian Leuz (Chicago) påpekade att ’få människor konsekvent tjänar riskjusterad avkastning högre än indexavkastning.’

Undersökningen genomfördes 2019 och inkluderar professorer från Harvard, MIT, Stanford, Chicago, Berkeley och andra toppuniversitet. Resultatet ger akademiskt stöd för det som många finansiella rådgivare länge förespråkat: för vanliga sparare är indexfonder den mest rationella strategin.

Sammanställning av svaren

Fördelning av svar:

- Strongly Agree: 51 ekonomer (56%)

- Agree: 27 ekonomer (30%)

- Did Not Answer: 13 ekonomer (14%)

Konfidensnivåer (för de som svarade):

- Genomsnittlig konfidens: ~8,1 (på en skala 1-10)

- Högsta konfidens (10): 17 ekonomer

- Lägsta konfidens (1): 1 ekonom (Liran Einav)

Nobelpristagare i listan:

- Bengt Holmström (Nobel, MIT) – Strongly Agree (10)

- Christopher Pissarides (Nobel, LSE) – Strongly Agree (10)

- Eric Maskin (Nobel, Harvard) – Agree (8)

- Oliver Hart (Nobel, Harvard) – Strongly Agree (8)

- Richard Thaler (Nobel, UChicago) – Strongly Agree (10)

- William Nordhaus (Nobel, Yale) – Strongly Agree (8)

Slutsats: Överväldigande majoritet (86%) av ekonomerna håller med om påståendet, med endast 14% som inte svarade och inga som uttryckligen höll inte med.

professorernas svar

Källor: De amerikanska professorerna svar och de europeiska professorernas svar. Min sammanställning nedan där jag har aggregerat ihop det.

| Namn | Titel | Svar | Konfidens | Kommentar |

|---|---|---|---|---|

| Aaron Edlin | Professor of Economics and Law, UC Berkeley | Agree | 8 | A typical investor will have a better risk return profile with a diversified fund of investments. |

| Abhijit Banerjee | Ford Foundation International Professor of Economics, MIT | Did Not Answer | – | – |

| Agnès Bénassy-Quéré | Professor of Economics, Université Paris 1 & Paris School of Economics | Strongly Agree | 9 | – |

| Alan Auerbach | Robert D. Burch Professor of Economics and Law, UC Berkeley | Strongly Agree | 9 | – |

| Alberto Alesina | Nathaniel Ropes Professor of Political Economy, Harvard (†2020) | Strongly Agree | 2 | – |

| Amy Finkelstein | Ford Professor of Economics, MIT | Did Not Answer | – | – |

| Angus Deaton | Professor Emeritus, Princeton University | Strongly Agree | 9 | At the individual level. Not clear if almost everyone did it. |

| Anil Kashyap | Professor of Economics and Finance, UChicago Booth | Strongly Agree | 7 | Great advice for almost everyone. We should all thank Jack Bogle |

| Antoinette Schoar | Stewart C. Myers-Horn Family Professor of Finance, MIT Sloan School | Strongly Agree | 9 | – |

| Austan Goolsbee | Professor of Economics, UChicago Booth | Strongly Agree | 10 | – |

| Barry Eichengreen | Pardee Professor of Economics and Political Science, UC Berkeley | Strongly Agree | 5 | – |

| Beatrice Weder di Mauro | Professor of International Economics, Graduate Institute Geneva | Agree | 5 | – |

| Bengt Holmström | Paul A. Samuelson Professor of Economics, MIT (Nobel) | Strongly Agree | 10 | – |

| Botond Kőszegi | University Professor, CEU & University of Bonn | Strongly Agree | 9 | – |

| Canice Prendergast | W. Allen Wallis Professor of Economics, UChicago Booth | Strongly Agree | 9 | – |

| Carl Shapiro | Professor of Economics, UC Berkeley | Agree | 8 | – |

| Caroline Hoxby | Professor of Economics, Stanford University | Agree | 10 | – |

| Charles Wyplosz | Emeritus Professor of International Economics, Graduate Institute Geneva | Strongly Agree | 9 | – |

| Christian Leuz | Charles F. Pohl Professor of Accounting and Finance, UChicago Booth | Strongly Agree | 9 | Lots of evidence. Few people consistently earn risk-adj. ret > index ret. And even then, much might be compensation for time & effort. |

| Christopher Pissarides | Regius Professor of Economics, LSE (Nobel laureate) | Strongly Agree | 10 | Even if you get it right some of the time eventually you will get it wrong |

| Christopher Udry | Professor of Economics, Northwestern University | Strongly Agree | 9 | – |

| Costas Meghir | Douglas A. Warner III Professor of Economics, Yale University | Strongly Agree | 10 | – |

| Daron Acemoglu | Institute Professor of Economics, MIT | Agree | 5 | – |

| Darrell Duffie | Professor of Finance, Stanford GSB | Strongly Agree | 9 | Absent private information, diversification lowers risk for a given mean return. (Sharpe) |

| David Autor | Daniel and Gail Rubinfeld Professor of Economics, MIT | Strongly Agree | 8 | – |

| David Cutler | Otto Eckstein Professor of Applied Economics, Harvard | Strongly Agree | 4 | – |

| Elena Carletti | Professor of Finance, Bocconi University | Agree | 8 | – |

| Eliana La Ferrara | Professor of Public Policy, Harvard Kennedy School | Did Not Answer | – | – |

| Emmanuel Saez | Professor of Economics, UC Berkeley | Strongly Agree | 8 | – |

| Eric Maskin | Adams University Professor Emeritus, Harvard (Nobel) | Agree | 8 | – |

| Ernst Fehr | Professor of Microeconomics and Experimental Economics, University of Zürich | Did Not Answer | – | – |

| Fabrizio Zilibotti | Tuntex Professor of International and Development Economics, Yale University | Agree | 9 | – |

| Francesco Giavazzi | Professor of Economics, Bocconi University | Did Not Answer | – | – |

| Franklin Allen | Professor of Finance and Economics, Imperial College London | Agree | 8 | In the absence of inside information, on average a diversified strategy should do better unless the person has good judgment. |

| Hans-Joachim Voth | UBS Professor of Macroeconomics and Financial Markets, University of Zurich | Strongly Agree | 9 | Just look at the long-term Warren Buffett bet against managed funds — whenever there is outperformance, fees eat them up |

| Henrik Kleven | Professor of Economics and Public Affairs, Princeton | Strongly Agree | 7 | – |

| Hilary Hoynes | Professor of Economics, UC Berkeley | Agree | 8 | – |

| Hélène Rey | Lord Raj Bagri Professor of Economics, London Business School | Did Not Answer | – | – |

| James Stock | Harold Hitchings Burbank Professor, Harvard | Agree | 8 | – |

| Jan Eeckhout | ICREA Research Professor of Economics, UPF | Strongly Agree | 10 | – |

| Jan Pieter Krahnen | Emeritus Professor of Finance, Goethe University Frankfurt | Strongly Agree | 8 | A quant hedge fund may extract extra return by big data strategies, but an average guy, like myself, will likely fail with stock-picking. |

| Jean-Pierre Danthine | Professor Emeritus of Economics, HEC Lausanne | Strongly Agree | 10 | – |

| John Van Reenen | Ronald Coase Chair in Economics, LSE | Strongly Agree | 7 | – |

| John Vickers | Warden of All Souls College and Professor of Economics, University of Oxford | Agree | 6 | Assuming a degree of risk aversion. However some investors might rationally want some exposure to assets not available passively. |

| Jonathan Levin | Hewlett Professor of Economics, Stanford University | Agree | 5 | – |

| Jordi Galí | Professor of Economics, UPF and Barcelona School of Economics | Agree | 8 | I agree with the statement as ”doing better” is interpreted to mean enjoying a higher average return for any given level of risk. |

| Joseph Altonji | Thomas DeWitt Cuyler Professor of Economics, Yale | Strongly Agree | 9 | – |

| José Scheinkman | Professor of Economics, Columbia University | Strongly Agree | 9 | – |

| Judith Chevalier | William S. Beinecke Professor of Finance and Economics, Yale SOM | Did Not Answer | – | – |

| Karl Whelan | Professor of Economics, University College Dublin | Strongly Agree | 10 | – |

| Katherine Baicker | Emmett Dedmon Professor, University of Chicago | Agree | 3 | – |

| Kenneth Judd | Professor Emeritus, Stanford University | Strongly Agree | 10 | This follows from basic statistics for risk averse investors. May fail with Friedman-Savage or similar utility not supported by data. |

| Kevin O’Rourke | Chichele Professor of Economic History, University of Oxford (emeritus) | Agree | 7 | – |

| Larry Samuelson | Professor Emeritus of Economics, Yale University | Strongly Agree | 8 | – |

| Liran Einav | Professor of Economics, Stanford University | Agree | 1 | – |

| Lubos Pastor | Charles P. McQuaid Professor of Finance, UChicago Booth | Strongly Agree | 10 | I interpret ”do better” in terms of a better risk-return tradeoff. Why take unnecessary idiosyncratic risk. |

| Lucrezia Reichlin | Professor of Economics, London Business School | Agree | 6 | – |

| Luigi Guiso | Professor, Einaudi Institute for Economics and Finance | Strongly Agree | 8 | for a typical investor I strongly believe a passive, cheap index is better than a passive portfolio of a few stocks |

| Luis Garicano | Full Professor of Economics and Strategy, LSE | Strongly Agree | 10 | – |

| Marco Pagano | Professor of Economics, University of Naples Federico II | Strongly Agree | 10 | A no-brainer. |

| Marianne Bertrand | Chris P. Dialynas Distinguished Service Professor, UChicago | Agree | 4 | – |

| Markus Brunnermeier | Edwards S. Sanford Professor of Economics, Princeton University | Agree | 9 | – |

| Martin Hellwig | Director Emeritus & Professor, Max Planck Institute / University of Bonn | Agree | 10 | The empirical evidence is overwhelming. |

| Michael Greenstone | Milton Friedman Professor of Economics, UChicago | Strongly Agree | 7 | – |

| Nicholas Bloom | William Eberle Professor of Economics, Stanford | Agree | 8 | This is the prediction of our basic ”no free lunch principle”. All my savings are in index tracker, so i am living this view! |

| Nicola Fuchs-Schündeln | Professor of Macroeconomics, Goethe University Frankfurt | Strongly Agree | 8 | – |

| Oliver Hart | Professor of Economics, Harvard (Nobel laureate) | Strongly Agree | 8 | – |

| Olivier Blanchard | Robert M. Solow Professor of Economics Emeritus, MIT | Strongly Agree | 9 | This is a no brainer. The only qualification is that the diversified portfolio may not be exactly the market portfolio. |

| Patrick Honohan | Honorary Professor of Economics, Trinity College Dublin | Strongly Agree | 10 | ”Do better” understood to capture risk as well as expected return, of course. |

| Paul De Grauwe | John Paulson Professor of European Political Economy, LSE | Agree | 8 | – |

| Per Krusell | Professor of Economics, Stockholm University & Centennial Professor, LSE | Strongly Agree | 9 | I don’t know of any convincing systematic evidence to the contrary. |

| Pete Klenow | Professor of Economics, Stanford University | Strongly Agree | 7 | – |

| Peter Neary | Professor of Economics, University of Oxford (†2021) | Strongly Agree | 8 | A small industry exists to help naive investors beat the market. It should be subject to mandatory health warnings. |

| Philippe Aghion | Professor, Collège de France, INSEAD, LSE | Did Not Answer | – | – |

| Pol Antràs | Robert G. Ory Professor of Economics, Harvard | Strongly Agree | 9 | Unless the investor is a risk lover |

| Rachel Griffith | Professor of Economics, University of Manchester | Agree | 8 | – |

| Rafael Repullo | Professor of Economics, CEMFI (Madrid) | Strongly Agree | 10 | – |

| Raj Chetty | William A. Ackman Professor of Public Economics, Harvard University | Strongly Agree | 7 | – |

| Ray Fair | Professor Emeritus of Economics, Yale University | Agree | 5 | – |

| Richard Baldwin | Professor of International Economics, IMD | Did Not Answer | – | – |

| Richard Portes | Professor of Economics, London Business School | Agree | 6 | – |

| Richard Schmalensee | Howard W. Johnson Professor of Management, MIT | Agree | 8 | – |

| Richard Thaler | Charles R. Walgreen Distinguished Professor, UChicago (Nobel) | Strongly Agree | 10 | Investing 101. |

| Richard William Blundell | Ricardo Professor of Political Economy, University College London | Did Not Answer | – | – |

| Robert Hall | Professor Emeritus of Economics, Stanford University | Strongly Agree | 9 | Assuming the ”few stock” are publicly traded. The non-traded equities held in PE funds probably return more, but the GPs keep the premium. |

| Robert Shimer | Alvin H. Baum Professor of Economics, UChicago | Agree | 10 | The index fund should give a similar expected return with substantially less risk. |

| Steven Kaplan | Neubauer Professor of Finance, UChicago Booth | Strongly Agree | 9 | – |

| Timothy J. Besley | W. Arthur Lewis Professor of Development Economics, LSE | Did Not Answer | – | – |

| Torsten Persson | Torsten and Ragnar Söderberg Chair in Economic Sciences, IIES, Stockholm University | Agree | 6 | – |

| Veronica Guerrieri | Tarrson Distinguished Professor of Economics, UChicago Booth | Strongly Agree | 8 | – |

| William Nordhaus | Professor Emeritus of Economics, Yale (Nobel) | Strongly Agree | 8 | – |

| Xavier Freixas | Emeritus Professor of Financial Economics, UPF | Did Not Answer | – | – |